Need to know

- Commonwealth Bank's Dollarmites program is a marketing ploy aimed at making kids lifelong customers

- We gave Dollarmites a 2018 Shonky for some very shonky practices

- Teaching kids to save money is a good thing – we point you to some better options than Dollarmites for learning financial literacy

UPDATE 25/10/21: Commonwealth Bank drops Dollarmites program

Kids can learn an important financial lesson from Commonwealth Bank's Dollarmites program – don't trust the banks, especially the big ones.

We handed Dollarmites a 2018 Shonky Award for good reason.

Masquerading as a program aimed at improving financial literacy for kids, Dollarmites has always been a marketing ploy aimed at locking in customers from the earliest possible age.

And you can see why the Commonwealth Bank (CBA) does it.

There is no evidence that having a bank account from an early age improves financial literacy

In a 2017 CHOICE survey, 84% of respondents said they got their first account with a big four bank (46% with CBA), and a third of them still had the account.

There is no evidence, by the way, that having a bank account from an early age improves financial literacy.

But with Dollarmites, the barrier to entry is virtually non-existent.

A youngster can open an account at any age as long as they're under 18, though they'll need parental approval if they're 13 or younger (presumably this applies especially to newborn babies).

If you're 14 or older, you can apply all by yourself!

Kids' dollars add up for CBA

Dollarmites is big business at CBA: the 92-year-old program is currently worth about $9.9 billion to the bank and had around 346,000 participants when we gave it a Shonky.

At the time, schools received a $200 commission when the first Dollarmites student customer was signed up, plus ongoing benefits depending on the number of students and the number of deposits each class member made.

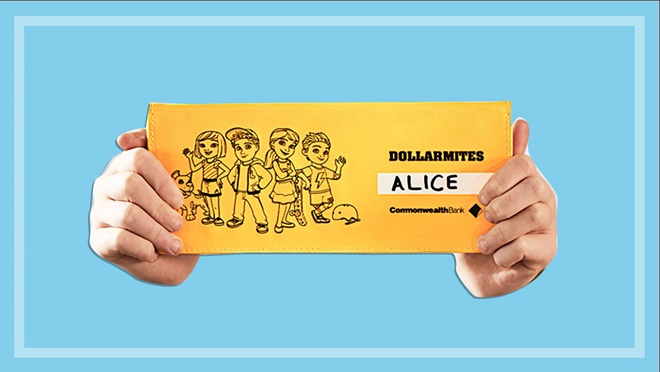

Then, as now, children are promised "a range of fun, engaging materials to help them learn and encourage them to save", including banking wallets, smartphone apps and crossword puzzles (featuring your favourite banking words).

These and other promotional items are branded in the signature Commonwealth Bank yellow.

There might be better options for kids than saving their coins at home – but a Dollarmites account isn't one of them.

When we investigated the program in the lead-up to the 2018 Shonky Awards, some of this "education material" turned out to be CBA credit card marketing material.

Bonuses were on offer for bank employees at the time. It emerged that thousands of CBA staff had fraudulently manipulated Dollarmites youth accounts for personal gain.

All of which is why we recommend that kids ditch their Dollarmites account and shop around.

We also call on the banking industry to get their marketing machines out of Australian schools, and we're not the only ones.

As reported by the ABC earlier last year, the Australian Education Union has gone on record to make the same demand.

"There's no place for private corporations to go into schools and try and trap children into banking with them for the long-term future," AEU president Correna Haythorpe told the ABC.

What to look for in a child's bank account

We're not saying kids shouldn't learn to save money and have a bank account to park it in.

They may even earn a little interest – probably very little, but something is always better than nothing.

Dollarmites pays a paltry standard rate of 0.1%, though you can earn bonus interest if you make a deposit at least once a month and don't take any money out, ever.

When looking for a new bank account for kids, make sure it meets the following criteria (this goes for adult accounts, too):

- No monthly fees with no conditions attached (e.g. a minimum monthly deposit or balance).

- Unlimited, unconditional and free own-bank ATM and EFTPOS transactions.

- A range of other unlimited transactions at no cost, including direct debit or credit, phone and internet banking, BPAY and over-the-counter service if applicable.

- Transaction accounts should be linkable to a savings account with a reasonable interest rate.

ASIC's free Moneysmart website also has some good tips on how to cultivate financial literacy in Australia's schools (letting the banks market to kids is not one of them).

Once you've found a better account, switch.

Join our campaign to get banks out of schools

For the first time ever, ASIC is currently reviewing school marketing schemes.

We hope you agree that banks have no place in Australian schools.

Join our campaign to fix school banking.

We're on your side

For more than 60 years, we've been making a difference for Australian consumers. In that time, we've never taken ads or sponsorship.

Instead we're funded by members who value expert reviews and independent product testing.

With no self-interest behind our advice, you don't just buy smarter, you get the answers that you need.

You know without hesitation what's safe for you and your family.

And you'll never be alone when something goes wrong or a business treats you unfairly.

Learn more about CHOICE membership today

Stock images: Getty, unless otherwise stated.