Need to know

- For decades, the Aboriginal Community Benefits Fund targeted remote First Nations consumers with low-value funeral insurance

- They made millions of dollars facilitated by the government's Centrelink deductions system, Centrepay

- Documents obtained by CHOICE show that for over a decade, Centrepay had no operational blueprint for deciding which companies should be able to use the system

Government support payments to low-income Australians are not meant to be siphoned off by dodgy businesses, yet that's exactly what happened in the case of Aboriginal Community Benefit Fund (ACBF).

The funeral expenses insurer ACFB, which later rebranded as Youpla, collapsed in March 2022, taking with it the premiums paid by many thousands of First Nations consumers and leaving them with nothing to pay for funeral and mourning arrangements that are a matter of profound cultural importance to First Nations communities.

Services Australia had no blueprint to protect welfare recipients

So how were Youpla's directors, five of whom are now facing legal action by the Australian Securities and Investments Commission (ASIC), able to receive payments directly from Centrelink by way of its Centrepay facility from 2001 to 2017?

How were Youpla's directors, five of whom are now facing legal action by the Australian Securities and Investments Commission (ASIC), able to receive payments directly from Centrelink?

Centrepay is an automatic deductions system, whereby approved businesses can deduct money straight from a welfare recipients account before it ever reaches them.

Documents obtained by CHOICE through a freedom of information request reveal that between 1998 and 2014, no operational blueprint existed to govern which businesses could receive payment through Centrepay.

According to Services Australia: "Operational Blueprints are internal Agency guides which set out the various procedures and reference material for Agency staff to follow. When making a decision, or processing an application, an Operational Blueprint may be followed to ensure best practice across the Agency."

The time period when Centrepay existed without an operational blueprint covers the John Howard Liberal government and the Labor governments of Kevin Rudd and Julia Gillard.

UPDATE 15/09/23: Following the publication of this article Services Australia contacted CHOICE to clarify that 'Operational Blueprints' only came into the Agency as a system in 2014 and Centrepay was not unique in existing without a blueprint prior to that year.

Dodgy company allowed to register with Centrepay

ACBF was approved to join the Centrepay deductions system in 2001 and was banned in 2017. It was the only funeral insurance provider approved during that time.

The company was approved despite several publicly known issues at the time, including the NSW Government briefly shutting the company down in 1992 via a legal injunction over their registration and ASIC legal action for 'misleading or deceptive conduct' in 1999. Several more legal cases against ACBF would follow in the coming years and the company later featured as an example of a dodgy company that avoided regulatory action at the banking royal commission.

Despite its name, ACBF was not an Aboriginal owned or run company. Ron Pattenden, who was born in the UK, was the director and owned the majority of the shares for decades.

ACBF sold low-value funeral insurance products to Aboriginal and Torres Strait Islander consumers, mostly in remote communities, and marketed itself as an Aboriginal business.

ACBF sold low-value funeral insurance products to Aboriginal and Torres Strait Islander consumers, mostly in remote communities, and marketed itself as an Aboriginal business.

After being approved by Centrepay, ACBF's business increased dramatically around the country.

The company received over $170 million in premium payments from Aboriginal and Torres Strait Islander policy holders over three decades, with the vast majority of it coming after it was registered on Centrepay in 2001 and through the deductions system.

Lack of due diligence

Members of the Save Sorry Business Coalition, the group led by First Nations advocates pushing for a comprehensive compensation scheme for ACBF/Youpla victims, say the documents obtained by CHOICE suggest that successive governments failed in their due diligence.

"As far as I am concerned the operational blueprint should have been the very first thing that should have been created before allowing dodgy organisations to take advantage of the most vulnerable," Veronica Johnson, senior financial counsellor from Broome Circle says.

Nicole Stobart, a senior lawyer at the Victorian Aboriginal Legal Service, agrees that harm from the aggressive selling of poor-value funeral plans could have been prevented.

"This situation was facilitated by decades of government and regulatory failure by agencies that could have prevented much of this harm from occurring. In particular, the role of the Department of Social Services and Centrepay created a de facto marketing and payments platform for the targeted exploitation of low-income Aboriginal and Torres Strait Islander families," she says.

This situation was facilitated by decades of government and regulatory failure by agencies that could have prevented much of this harm from occurring

Nicole Stobart, Victorian Aboriginal Legal Service

Solicitor Mark Holden from Mob Strong Debt Help says the Centrepay accreditation gave ACBF a business advantage at the time.

"ACBF getting this accreditation made targeting First Nations people on Centrelink benefits a top priority. It gave ACBF a massive boost to their business and allowed them to operate far longer than they probably could have without it," he says.

ACBF was finally banned from the Centrepay system in 2017, which along with other interventions such as the damning findings at the royal commission and not being granted a new financial services licence to sell insurance, marked a period of decline for the company that ultimately led to its liquidation.

Services Australia responds

Not only did Services Australia not have an operational blueprint until 2014, they also say they were unable to locate any other guidelines for staff on the matter of when to accept businesses onto Centrepay.

A spokesperson for Services Australia noted that the documents requested by CHOICE were over 20 years old and that communication at the time was largely through fax, phone and post.

"While we of course had policies and procedures to guide staff before Operational Blueprint was created in 2014, we can't retrieve much older documents with our current systems. Since the Centrepay pilot evolved into a longstanding program, we've continually improved it in line with best practice and customer outcomes. It has always operated under strict terms and conditions," the spokesperson said.

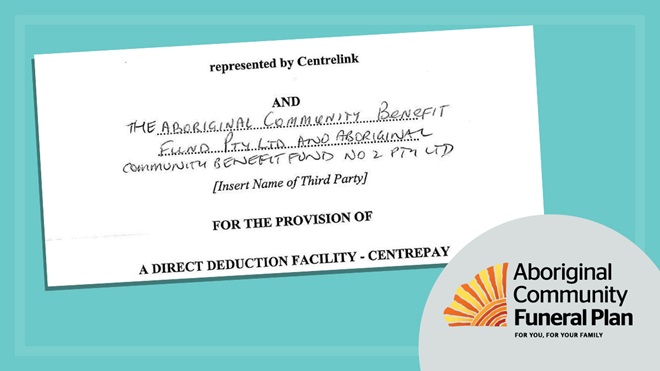

While the agency was unable to locate any past policies or procedures, Services Australia was able to locate the original hand-written application from ACBF to join the Centrepay deductions system in December 2000, which was provided to CHOICE through a separate freedom of information request.

ACBF's original hand-written application to join Centrepay was provided to CHOICE under Freedom of Information.

Compensation scheme coming

In July 2022 the federal government announced a $4 million temporary scheme to cover the funeral costs of some Youpla/ACBF policy holders who had recently passed away on or after April 2020.

That temporary scheme comes to an end on November 30 this year and the Save Sorry Business group say they have been assured by the Minister for Indigenous Australians Linda Burney that a permanent resolution will be established "within months" and prior to the expiry of the temporary scheme.

The need for the government to acknowledge this would certainly make all the clients signed up starting from 2001 eligible for compensation

Veronica Johnson, Broome Circle

Johnson says that there was a need for the permanent resolution to compensate everyone who signed up to ACBF/Youpla back to the year 2001. She says a failure to do so would be the government "not taking responsibility for mistakes".

"What started as a new initiative with the government was not properly designed, monitored or managed, the need for the government to acknowledge this would certainly make all the clients signed up starting from 2001 eligible for compensation, there is no other answer to this question," she says.

The office for the Minister for Financial Services Stephen Jones, who has been spearheading discussions along with Minister Burney, did not respond to CHOICE's request for a comment for this story.

Stock images: Getty, unless otherwise stated.